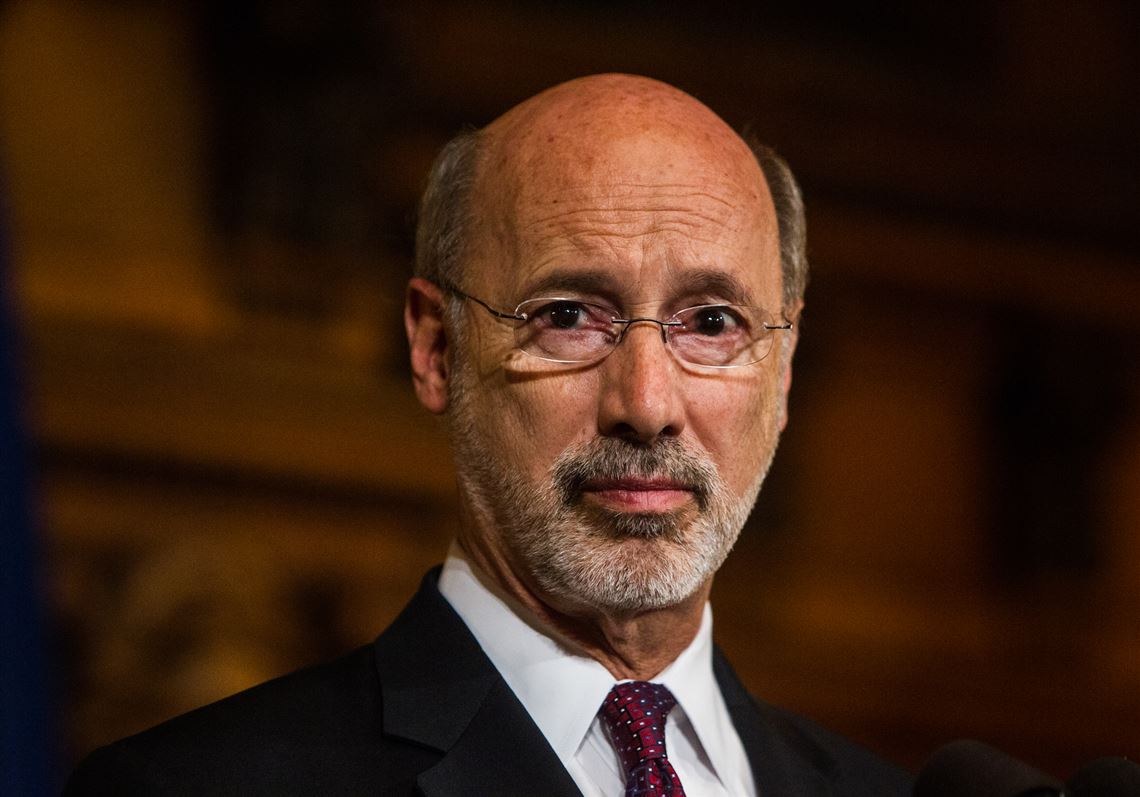

HARRISBURG — As he left the governor’s office Tuesday, a week after Gov. Tom Wolf vetoed a GOP-crafted state budget, Senate Republican leader Jake Corman said neither side is yielding on whether Pennsylvania should raise its sales and personal income taxes.

“This is going to be awhile,” Mr. Corman said. “The governor’s holding to the fact that he needs a broad-based tax increase. We don’t believe that we do. And until that issue can be resolved, we’re going to be here awhile.”

Legislators are charged with approving a state budget each fiscal year, which begins July 1. Without a budget, Pennsylvania loses its authority to make certain payments. The Wolf administration has said that operations will continue at state facilities, such as state parks and PennDOT offices, and in areas affecting health and safety, but that most payments to vendors and grant recipients will be delayed.

Mr. Wolf, a Democrat, had proposed enacting a number of significant changes in this year’s budget. He called for raising the rates of the sales and personal income taxes and extending the sales tax to products and services that are now exempt. Some of that money would have been used to subsidize local property taxes. The governor has also called for imposing a severance tax on natural gas drilling and significantly increasing state funding for schools.

Republicans said there was no support for the plan and wrote their own budget, which would have included a smaller increase in education funding and no tax increases. Mr. Wolf vetoed that budget, saying that it was not balanced and shortchanged the needs of schools.

Since then, there has been little progress toward a budget, though the governor and legislative leaders, as well as their staffs, have met.

“We’re open to discussions about some more revenue sources, if that’s what he needs, around the edges,” Mr. Corman, R-Centre, said Tuesday after meeting with Mr. Wolf. “But we’re not open to a discussion on an income tax increase. We’re not open to a discussion on a sales tax increase. We’re not open to a discussion on closing sales tax exemptions. Those broad-based tax increases are not going to be part of the discussion.”

Jeffrey Sheridan, spokesman for Mr. Wolf, said the governor wants to continue conversations about how to reach “the final compromise.” But he said new revenue is needed.

“He wants to find recurring revenues to close the structural budget deficit that we have, and the only way to do that is to find those new revenues,” Mr. Sheridan said.

Mr. Corman’s office announced Tuesday afternoon that the Senate will be heading back to town next week for voting sessions on Monday, Tuesday and Wednesday.

In addition to the main spending bill, Mr. Wolf vetoed accompanying legislation, as well as a Republican bill that would have closed the state liquor stores and permitted private sales of wine and spirits. Still on his desk is a bill that would end the traditional defined-benefit pension plan for most future state and public school workers.

Karen Langley: klangley@post-gazette.com

First Published: July 8, 2015, 4:00 a.m.