So you and a couple of buddies want to start a business. Good for you.

You decide to split ownership of the enterprise equally among the three of you, then pat yourselves on the back and go out for beers, celebrating your first decision together.

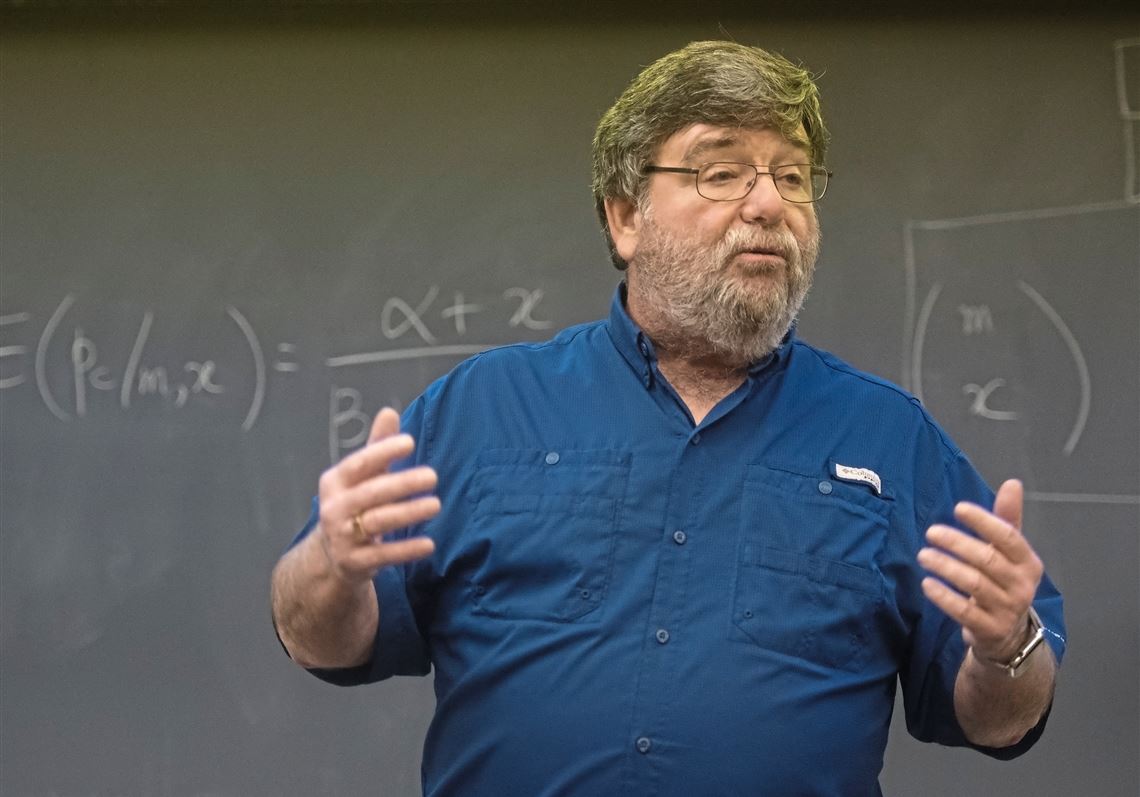

Equally splitting equity in a startup makes perfect sense — except when it doesn’t. And Frank Demmler thinks an equal split almost never makes sense.

Nothing sours friendships faster in the startup world, he said, and nothing will put your net worth in the toilet faster.

“They have no idea of what exactly they’re going to get into,” said Mr. Demmler, who is vice president of entrepreneurial services at North Side-based Innovation Works, a startup accelerator and seed-stage investor. “The reality is it couldn’t be more unfair. It’s most severely difficult to fix.”

In more than 30 years of advising entrepreneurs in Pittsburgh’s startup world, Mr. Demmler’s work has led to the formation of over 500 companies, creation of some 10,000 jobs and $1 billion in investment capital — numbers he compiled in 1998 and uses as part of his pitch in giving speeches. Actual totals now are much higher, in his estimation.

“He is just so ingrained into the fabric of startups and entrepreneurship in Pittsburgh,” said Dave Mawhinney, executive director of the Swartz Center for Entrepreneurship at Carnegie Mellon University. He met Mr. Demmler as a graduate student in 1988. “He’s been so instrumental to us.”

Founder’s Pie Calculator

Mr. Demmler preaches a better way to divide ownership of a company in his Founder’s Pie Calculator, which he committed to paper in 2003 or 2004 and had copyrighted.

More than half of Pittsburgh-area startups make the mistake of dividing ownership stakes equally among the founders, he said, planting the seeds for ruination almost as soon as the business is born.

The 68-year-old Mr. Demmler, who lives in Edgewood, is a managing director at for-profit Riverfront Venture Fund. The fund was created in 2014 by Innovation Works with $23.7 million in starting capital for early stage companies. With funding from the state and other sources, Innovation Works distributes up to $5 million a year in seed money.

Mr. Demmler has a bachelor’s degree in mechanical engineering from Princeton University, an MBA from the University of California at Los Angeles and has done post-graduate work at Harvard Business School. And the man, who traces his roots in Pittsburgh to a tinsmith who arrived in the city in 1835, has burnished a reputation for being so plainspoken that it can be alarming.

“You’re not an entrepreneur until you’ve been hit upside the head with a ‘two-by-Frank,’” said Mr. Mawhinney.

The ‘two-by-Frank’ description was born at an investor’s conference 12 years ago on the 53rd floor of the U.S. Steel Building. There, Mr. Mawhinney and four other hungry entrepreneurs prepared a practice pitch for Mr. Demmler, who would coach them on their presentation, then help them raise investment money.

“It was a pivotal meeting for the company,” Mr. Mawhinney said. Mr. Demmler listened patiently until they were done, then exploded.

“This is bull----,” he thundered. “This isn’t the internet bubble again! This is crap!”

Mr. Mawhinney remembered his colleagues pinned back in their seats, looking as though, “Our important investor hates us.”

“The way it came across was frightening,” he recalled.

Mr. Mawhinney was the only one in the group to know that Mr. Demmler was just being himself — gruff, no-holds-barred and, above all, concerned about their welfare.

His biggest fear

He’s so concerned about the welfare of the companies he advises that Mr. Demmler’s biggest fear is offering advice “that somehow causes failure or offering advice that’s misinterpreted,” he said.

Entrepreneurs, he added, “put family and lives on the line to pursue a dream.”

About one-third of the entrepreneurs he counsels walk away after meeting him, Mr. Demmler said. But many return, he said. Another third abandon dreams of changing the world and becoming rich and get a regular job.

“He’s the real deal,” said William Newlin, chairman of Sewickley-based private equity firm Newlin Investment Co. LLC. “He’s genuine.”

Pittsburgh can be an unforgiving place to pursue an entrepreneurial dream: the city’s metro area ranked 39th in startup activity by the Ewing Marion Kauffman Foundation, even though Mr. Demmler said two-thirds of Innovation Works’ companies are either economically viable or are acquired by other entities.

“I’m opinionated and I’m going to share some of my opinions with you,” Mr. Demmler recently told the principals of a new startup. “Seventy percent of what I tell you will be bull—, 30 percent will be gold and you have to figure out which is which.”

The startup that Mr. Mawhinney was involved in was eventually acquired by the professional networking outfit LinkedIn Corp., the San Francisco-based professional networking company.

His counsel also paid off in 2002 for Bill Kaigler, who is now entrepreneur-in-residence at the Swartz Center for Entrepreneurship at CMU.

At the time, Mr. Demmler was running a boutique venture firm called the Future Fund. His advice was simple: “Go away and come back to me with your highest risk in this business and how you’re going to eliminate that risk,” Mr. Kaigler said.

Mr. Kaigler pivoted to a new business model. The result was that he co-founded medSage Technologies LLC, a patient compliance software company, which was acquired by sleep and respiratory products company Respironics in 2011.

The Founder’s Pie Calculator is intended to force sometimes difficult discussions:

• Who did what to come up with the business idea?

• Who contributed what in conceiving the business model?

• Who has the industry connections?

• Who is joining the company full time?

• Who is responsible for bringing the product to market?

Each founder is given points for contributions to the business idea, business model and other factors. The score is used to determine ownership share.

“Not addressing the issues now is like the ostrich burying its head,” he writes in a user manual of sorts for the calculator. “The situation is likely to get worse, not better. DO IT NOW!”

About that equity split

Don’t believe that ruin awaits startups that split equity equally? Mr. Demmler offers these glimpses of your future:

• You put in 10-hour days, six days a week and your partner shows up at 10 a.m. and leaves at 3 p.m., except on days he can get an earlier tee time.

• You quit your job, forgo salary while your partners stay in their jobs to help fund the business until it can afford to pay them.

• You want to raise investment to help the company realize its potential, but your partners don’t want to take the risk. “We’re doing just fine the way we are,” they say.

“I could go on and on,” Mr. Demmler writes in his user manual, “but I think you get the picture.”

For Craig Markovitz, co-founder of Blue Belt Technologies Inc., a surgical device and CMU spinout company, Mr. Demmler’s talent was getting entrepreneurs to see their product from an investor’s perspective, positioning the company as a compelling opportunity.

Mr. Demmler provided counsel for early investment rounds for Blue Belt, which was acquired last year for $275 million by London-based medical products company Smith & Nephew.

“He was very focused on the task at hand, on what we needed to do: How should our technology perform? How will the market benefit? How will this technology create value?” Mr. Markovitz said.

“It was a badge of honor to get through the lunch and learn with Frank Demmler.”

In two years, when he turns 70, Mr. Demmler said he’ll reconsider his career. Entrepreneurship is essentially all that he’s known.

“I’m in for the long haul,” he said. “I don’t know what I’d do if I didn’t do this.”

Kris B. Mamula: kmamula@post-gazette.com or 412-263-1699.

First Published: December 4, 2017, 11:00 a.m.