GNC officials on Thursday took pains to distance the company from the “old” GNC after reporting a $433.4 million fourth-quarter loss, marking the end of a dismal 2016 that saw a 64 percent decline in the Pittsburgh health supplement retailer’s share price.

For the year, GNC Holdings Inc. recorded a net loss of $286.3 million, compared with a $219.3 million profit the year before, as sales declined 6.5 percent and 6.8 percent respectively in company-owned and franchise stores. GNC’s consolidated revenue of $2.54 billion was a 5.3 percent drop from 2015’s $2.68 billion. Its adjusted earnings per share was 7 cents, far off Wall Street’s estimate of 36 cents per share.

“This is certainly not what any one of us wanted to see,” said interim CEO Robert Moran of GNC’s fourth-quarter performance during the company’s quarterly financial briefing to analysts.

The losses, said Chief Financial Officer Tricia Toliver, “are not a good indication of where the business is headed,” adding later that, “We are building an entirely new business model.”

Ms. Toliver was referring to the “One New GNC” campaign, launched Dec. 29 to rebrand the health and wellness retailer. The “new” GNC now features simplified pricing, reduced prices on about half of its products, and a free customer loyalty program, with plans to offer new proprietary products.

Mr. Moran said company officials are encouraged by the campaign’s early results, with sales transactions up 7 percent among company-owned stores and an even more promising performance among the GNC stores that have been piloting the program.

It undoubtedly can’t come soon enough for investors who, shortly after the GNC financials were released early Thursday, learned the GNC board was suspending the company’s quarterly dividend. Shares briefly fell below $7 for the first time since the company went public in 2011.

The stock closed at $7.72 Thursday, down 7.21 percent.

Ms. Toliver said the fourth quarter had notable one-time expenses such as a $10 million investment to clear inventory and launch the One New GNC campaign. As part of its preparation, GNC closed all of its stores for the day on Dec. 28, which also cut into sales. She also said the company expects to close about 100 stores this year as leases expire.

“We believe we are on the right path.”

It’s been a bumpy path for GNC since its wildly successful initial public offering in April 2011, which saw company shares double in value that first year.

But a variety of factors — including increased competition, confusing pricing and promotions, and a general perception by consumers that its products were too expensive — led to a precipitous drop in the stock the past 18 months.

Mr. Moran called the resulting declines in revenue “an indication of a company that has lost touch with its customers.”

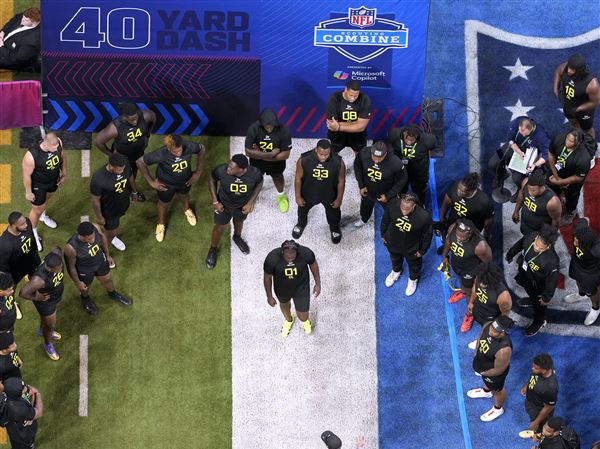

The rebranding of GNC has had its stumbles, though, most publicly when the company announced with some fanfare plans for a first ever Super Bowl commercial, only to have the National Football League reject the ad a week before the game because a small percentage of GNC products contain substances banned by the NFL.

Earlier this month, GNC told Fox Broadcasting that it intends to pursue legal action, saying the network had previously approved the ad and that the public rejection caused “significant economic and reputational damages.”

Mr. Moran on Thursday called the episode disappointing but noted the ad did air during last weekend’s Grammy Awards show and will be shown again during the Feb. 26 Academy Awards broadcast.

Mr. Moran took over as interim CEO in July, replacing Mike Archbold. He said Thursday he will continue in that role for another six months while the company conducts a search for a permanent CEO, after which Mr. Moran plans to remain as a member of the GNC board of directors.

Steve Twedt: stwedt@post-gazette.com or 412-263-1963.

First Published: February 16, 2017, 2:49 p.m.

Updated: February 17, 2017, 5:38 a.m.