There are generally two types of families that enter our office: those in a medical crisis and those concerned about a future medical crisis.

As you can probably imagine, the first situation typically results in fewer options because of the increased stress on the patient and family, hurried choices about medical treatment and future living conditions, and greater financial concerns.

It’s a given that as we age, our medical needs increase just simply because our bodies are wearing out. While some of us may live to be 100 years old — and others much less — the goal is survival in whatever form that means to a person.

The concept of aging and the many choices that come with it are well-documented and the topic of many a conversation among families. So, if we’re talking about survival, why do so many people bring a penknife instead of a Swiss Army knife to this adventure?

One of the reasons is that many just don’t have good information. Addressing aging issues involves a three-pronged approach: medical, financial and legal.

Frequently, we see families appear at our office with nothing more than a basic set of estate planning documents that are geared toward reacting to some future crisis; generally, death or long-term disability. Along with that, they bring the proverbial “suitcase” or metal box of documents that tell their life story, mostly from a legal and financial perspective.

Few people put it all together in advance.

While many people may have engaged a lawyer, financial planner and several doctors, they have never integrated the disciplines to form a cohesive plan that addresses needs along the continuum of care as they age.

Another reason people don’t plan in advance is that family dynamics prevent the conversation from happening. Adult children frequently see their parents “slipping,” but as one of our clients once said, “You try to get my father to sit down and listen because I can’t.”

True, a person who is adamantly opposed to advanced planning is poses a difficult scenario. However, one way to balance this position is to educate the caregiver instead of the “careneeder,” so to speak.

For example, generally a spouse or an adult child will be the one to answer the call when the medical crisis occurs. Therefore, that person can start gathering information now to reduce the unknowns when important decisions need to be made in a hurry.

One of the first things we do with new families is ask for copies of their current estate planning documents and have them complete a questionnaire to ascertain family and financial information.

If the person of concern is not interested in planning ahead, the other family members can work together to accumulate information while there are still options available.

Ultimately, we cannot stop the hands of time nor predict the medical challenges one will face. But, getting the other two legs of the planning stool (legal and financial) in order prior to a crisis will help maximize the options available at that time and expedite the analysis and course of action.

Most importantly, knowing the legal and financial bases are covered allows the family to focus their full attention on the most important aspect of the medical crisis — getting good care and making educated choices about future care needs.

We’ve never had a client who came into the office joyfully anticipating going to a long-term care facility. While there are many such facilities that serve an important function, promoting the safety and care of their residents, this is a setting for chronically ill people who — you guessed it — don’t have a lot of other options.

In the alternative, those families coming in who are concerned about a potential future medical crisis are asking the question, “How do I stay out of the nursing home for as long as possible until it’s absolutely necessary?”

Retirement is more than just stretching out your finances to live comfortably. Over 60 percent of us will need long-term care and we’ll need to figure out how to deal with it, successfully, on several levels.

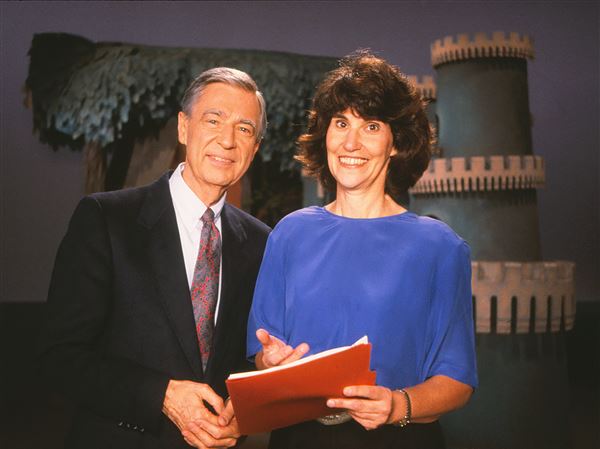

Julian Gray and Frank Petrich are certified elder law attorneys who practice in the Pittsburgh area at Gray Elder Law. Send questions to elderlawguys@grayelderlaw.com or visit www.grayelderlaw.com.

First Published: March 26, 2018, 1:00 p.m.