An unprecedented confrontation between Republicans who control the state Senate and Revenue Secretary Pat Browne intensified Tuesday as senators voted to have him brought before them within three session days - meaning on or before Oct. 22 - to answer questions.

The resolution that directed that potential action by the Senate Sergeant-at-Arms was approved in a 28-22, party-line vote, with all Republicans in favor and all Democrats opposed. Sen. Joe Pittman, R-Indiana and the Republican majority leader, said they simply want Mr. Browne to answer questions on why he will not divulge some tax information sought in a subpoena issued by the Senate in July.

“There will not be a paddywagon out on the ramp to send him to jail,” Mr. Pittman said of any potential Senate appearance by Mr. Browne.

Nonetheless, the resolution states that if Mr. Browne continues to refuse to disclose the information, he could be found in contempt and imprisoned.

Mr. Browne filed a lawsuit in Commonwealth Court Monday afternoon seeking to block the move to have him appear in the Senate. And during the debate on Tuesday, Sen. Jay Costa, D-Allegheny and the top Democrat in the Senate, said another lawsuit was coming

Mr. Costa accused Republicans of using “an obscure process” that has never been used in his Senate career of nearly 30 years to circumvent a statute that keeps certain tax information confidential. Mr. Costa said that Mr. Browne is “being honest” in refusing to disclose information that is confidential by law.

Senate President Pro Tempore Kim Ward, R-Westmoreland, said the refusal by Mr. Browne and the administration of Gov. Josh Shapiro raises more questions in itself.

“I am thinking, ‘What are you hiding?’” Ms. Ward said. Of the lawsuit, she said, “Why would they do that? What are they hiding?”

The tax information is tied to the Allentown Neighborhood Improvement Zone. The special tax zone in the eastern Pennsylvania city was created by a law that Mr. Browne wrote more than a dozen years ago when he was a Republican senator from Lehigh County.

Since then, a total of well over $500 million in tax revenue in many different categories that otherwise would have gone into state coffers has been used to spur development in Allentown.

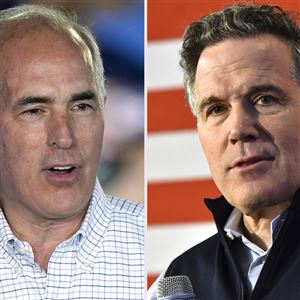

Until late 2022, Mr. Browne was the Republican chairman of the powerful Senate Appropriations Committee. He was defeated in his bid for re-election by Jarrett Coleman, a newcomer to state-level politics, and Mr. Shapiro subsequently picked Mr. Browne as revenue secretary.

On Dec. 14, 2023, the Senate voted 50-0 to have the bipartisan Legislative Budget and Finance Committee audit the NIZ. During its evaluation of the zone, the committee determined that to carry out the task, it needed the totals of every type of tax generated in the zone.

Mr. Browne has said he provided as much as he was legally able to, and that providing all the figures would require him to violate confidentiality provisions in state law. Now-Sen. Coleman is chairman of the Senate committee that in July issued the subpoena seeking the same specific tax information on the so-called “NIZ.”

The process that led to Tuesday’s vote on the resolution began after Republican senators determined Mr. Browne had failed to comply fully with the subpoena.

Sen. Anthony Williams, a Philadelphia Democrat, said Republicans were not justified in singling out the NIZ, and that other tax-related programs should get the same scrutiny. “This will not fare well with the public,” Mr. Williams said.

A spokesperson for the Revenue Department on Tuesday responded to a request for comment by referring to Mr. Browne’s court filing. A spokesperson for Mr. Shapiro did not immediately provide comment.

Mr. Browne said in his court filing that he is in an “untenable position” in which he risks incarceration if he discloses the information; but also risks incarceration if he fails to respond fully to the demands of Senate Republicans.

He asked Commonwealth Court to rule that he cannot be compelled to disclose confidential information; to block Senate leaders from seeking to compel him to do so; and enjoin them from declaring him in contempt or having him taken into custody.

In other action on Tuesday, the Senate approved a measure to have the state set up a program that would let older adult volunteers with subject matter expertise work with public school pupils before, during or after school hours.

The prime sponsor, Rep. Jared Solomon, D-Philadelphia, said in a memo that lawmakers “should do all we can to give older adults a chance to share their knowledge with young people, and also give teenagers an opportunity to interact with someone of a different generation.”

The bill previously passed the House, but will require another vote there because it was amended in the Senate.

First Published: October 8, 2024, 10:42 p.m.

Updated: October 9, 2024, 3:01 p.m.