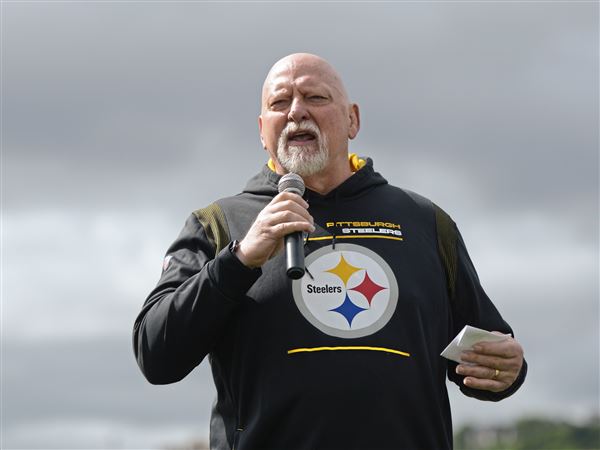

Frank V. Cahouet, the feisty retired chief executive credited with rescuing Pittsburgh’s iconic Mellon Bank from the brink of failure in the late 1980s, died at his Sewickley Heights home Tuesday of complications from Parkinson’s disease. He was 85.

A Boston native, Mr. Cahouet worked some 25 years at major banks in California before arriving at Mellon Financial in 1987, the first CEO not to have risen from inside the bank’s ranks.

At the time, the Pittsburgh institution founded in 1869 was hemorrhaging red ink under the weight of soured loans and bloated expenses. Regulators were circling.

Mr. Cahouet’s workaholic ways, vision and laser focus led the transformation of the failing institution into a trendsetter and remolded it into one of the most profitable financial institutions in the nation.

He retired from Mellon at the end of 1998. The bank was acquired by New York City’s Bank of New York in 2007, forming Bank of New York Mellon.

Following his retirement, Mr. Cahouet remained active in the Pittsburgh community, serving on numerous boards, including the University of Pittsburgh, Carnegie Mellon University, Pittsburgh Regional Alliance, World Affairs Council of Pittsburgh, Historical Society of Western Pennsylvania, Teledyne Technologies and others.

His health had been deteriorating since his diagnosis of Parkinson’s a few years ago, news he greeted with his characteristic no-nonsense style.

“It’s a tough deal. But what are you going to do about it? Sit around and moan and groan?” he said in an interview with the Pittsburgh Post-Gazette last year.

Instead of complaining, he underwent physical and speech therapy. And he donated funds to Allegheny Health Network to create the Cahouet Center for Comprehensive Parkinson’s Care, which opened in 2016 in Bellevue and is aimed at streamlining services and information for patients.

Donald Whiting, a neurosurgeon with Allegheny Health Network, said Mr. Cahouet was affable and driven, “a gentleman who instilled confidence and energy into people to get them to line up and work toward a common goal.”

“He was one of the nicest people I ever met,” Dr. Whiting said.

“Frank will be fondly remembered as a business leader who did not shy away from the most daunting of challenges and as a pillar of the Pittsburgh community,” BNY Mellon Chairman and CEO Gerald Hassell said in an email to employees Wednesday.

His decisive actions to stem losses, which included massive layoffs, “saved Mellon,” Mr. Hassell said.

Mr. Cahouet arrived at Mellon in June 1987, two months after his predecessor, J. David Barnes, resigned under board and investor pressure. The once-proud institution that had financed the region’s rise to industrial prominence had suffered a $60 million loss in the first quarter that year, the first red ink in its history, which would balloon to nearly $1 billion by year end. Quick action by the board in bringing in new leadership was seen as a key move that helped save Mellon from a government-assisted sell-off.

Mr. Cahouet quickly slashed costs, firing about 3,000 people. He knew the layoffs would be painful but had to be done “for the good of the remaining company,” he said in a 1998 interview from his Downtown office shortly before his retirement. A devout Catholic, he relied on his faith to help “square it away.”

The cornerstone of his turnaround plan was the formation of Grant Street National Bank, the so-called “bad bank” created to liquidate nearly $1 billion in defaulted loans. The novel approach, which allowed Mellon to immediately begin new life as a healthy bank, was financed with $500 million in junk bonds that were to be paid off with proceeds from asset sales.

In subsequent years, Mr. Cahouet helped lay the foundation for BNY Mellon’s current role as a leading investments company, engineering the blockbuster purchases in the early 1990s of the venerable money manager The Boston Co. and the New York-based mutual fund giant Dreyfus Corp.

During his nearly 12-year tenure at Mellon, his demanding, sometimes gruff style bruised a few egos and earned him a few detractors.

Mr. Cahouet, however, was unsympathetic.

“I make no apologies for people working too hard,” he said in his 1998 interview.

He also was known for his iron grip on costs, which he declined to relax once the bank was back on track.

“Good management is always testing the expense base, always,” he said. Loosening up “is a good way to get back into trouble.”

“If you were running for a popularity poll, what you do is put a turkey in everybody’s refrigerator…[but] I owe it to our people, as I owe it to our shareholders, to make gosh darn certain that this company is successful.”

Roughly 10 years after leaving Mellon, Mr. Cahouet led an effort to raise $1 billion in capital to launch National Bank Holdings Corp., formed to acquire troubled community banks in the midst of the financial crisis. He retired as founding chairman there in 2015 and as a director last year.

The Rev. Thomas J. Burke, pastor at St. James Catholic Parish in Sewickley, came to know Mr. Cahouet and his wife, Ann, over the last five years as “regular folks, humble and down-to-earth.”

“He would come [to mass] in jeans and a flannel shirt. You’d never know he was a CEO,” Father Burke said. “He was real quiet, not flashy. He had a heart of gold.”

In his interview last year, Mr. Cahouet said that looking back, he had no real regrets in his life.

“We’re very happy in Pittsburgh,” he said. “I have a super wife who’s been incredibly supportive over the years and great kids.”

“I have no business having any regrets.”

In addition to his wife, Mr. Cahouet is survived by four children: Ann P. Cahouet, Frank Cahouet Jr., Mary Cahouet-Rotondi and David Cahouet, plus six grandchildren.

Arrangements, which were incomplete, are being handled by R.D. Copeland funeral home, 702 Beaver St., Sewickley.

Patricia Sabatini: PSabatini@post-gazette.com; 412-263-3066.

First Published: June 21, 2017, 3:33 p.m.