With more than 54,000 workers and projects valued over $4 billion, the construction industry in Southwestern Pennsylvania is considered one of the largest in the Commonwealth, according to Joel Niecgorski, vice president of the local union Eastern Atlantic States Regional Council of Carpenters.

But the industry also “leads the pack” in illegal practices like tax fraud, worker misclassification, off-the-book payments and unsafe working conditions, he said.

“It’s imperative that this process stops. It’s eroding our industry, it’s eroding our communities,” Mr. Niecgorski told lawmakers Tuesday. These contractors and developers “should no longer be able to line their pockets on the backs of the taxpayers and the workers.”

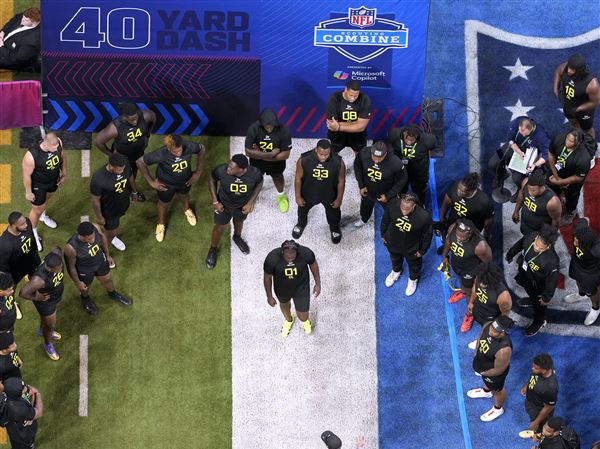

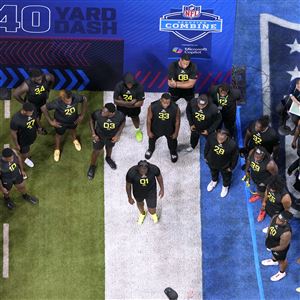

In 2018, the City of Pittsburgh set out to create a tax fraud task force to address alleged illegal practices in the construction industry. On Tuesday, representatives from the task force got state lawmakers involved.

The group gave a presentation to the Pennsylvania Senate’s Labor and Industry Committee at the Pittsburgh headquarters of the Eastern Atlantic Regional Council of Carpenters to push for action to both protect workers in the industry and hold employers accountable.

“We need to think about community wealth. We need to think about bringing jobs to our communities, local people, local contractors,” said Steve Mazza, a representative from the task force and the Pittsburgh Building Trades.

The task force defines tax fraud as either using “unscrupulous subcontractors” who operate without proper licenses and pay workers off the books or misclassifying workers as independent contractors rather than employees.

For workers, the misclassification means they don’t have access to protections like minimum wage requirements, overtime pay, worker’s compensation, health insurance and other benefits. For employers, it means they’re not paying into things like the state’s unemployment compensation system or paying the same tax rate to federal, state and city governments.

The rise of the gig economy and companies like Uber and DoorDash that are changing how people can make a living has brought renewed attention to the question of how to define a worker versus an independent contractor.

The Department of Labor under former President Donald Trump outlined guidance for answering that question based on things like whether the worker provides their own equipment, makes their own hours and takes on any losses if the job doesn’t go well. President Biden’s Department of Labor later put that guidance on hold.

In the construction industry, tax fraud also comes with concerns about safety. Employers who commit tax fraud may be working with subcontractors who operate without proper licenses or insurance and may not train workers on proper safety practices.

“Safety is one of your most expensive costs when you’re doing a job,” Mr. Niecgorski said. “You’ve got to have all the hand rails, the vests and all the materials you need to create a safe work condition.

“When these guys are looking for corners to cut, the first thing, the easiest thing to cut is safety.”

Because they are saving costs on things like safety practices and worker benefits, employers who are committing tax fraud could have a 30% bid advantage compared to competitors who follow the tax rules, Mr. Niecgorski said.

On a $100 million project, that amounts to about $12 million in labor costs.

The representatives from the task force said most of that money goes into contractor’s pockets.

On a job site where workers make $20 an hour and work 60 hours a week, the federal, state and city governments and programs lose about $213 per worker each week, based on data the task force presented. For a job site with 40 workers, that amounts to about $8,520 lost each week.

“These guys are making a good buck. It’s off the table and no tax fee collected,” Mr. Niecgorski said.

The task force also expressed concerns about so much cash going off the books. That brings up “darker” worries about money laundering, forgery and human trafficking, they said.

State representatives have been paying attention to the issue of worker misclassification and tax fraud across industries, said Sen. Camera Bartolotta, a Republican representing the 46th district and the chair of the Labor and Industry Committee.

In October 2020, the General Assembly established a joint task force to create methods to accept complaints about misclassifications and ensure timely enforcement as well as educate employees, employers and the public.

In October 2019, the General Assembly passed legislation that required employers to use a federal E-verify system to confirm an employee is legally authorized to work in the United States.

When the Pittsburgh Construction Industry Tax Fraud Task Force was first created in December 2018, backers emphasized that the bill was not about immigration, though past approaches to construction industry fraud did reference undocumented workers.

The task force is scheduled to provide a report to the general assembly by March 2022, Ms. Bartolotta said. On Tuesday, the two representatives from the group provided a set of recommendations including:

- Evaluating and amending the Office of Management and Budget contracting process,

- Strengthening regulations on use of public subsidies,

- Building stronger relationships with municipal judges and

- Creating protections for workers who report labor violations.

For workers, the risk of reporting a violation is high, Mr. Niecgorski said. The worker would be on the hook to pay back taxes for the income they made under the table and would likely be blackballed from the industry.

The task force said it is discussing eliminating the requirement to pay back taxes for workers who are willing to testify and “shed light on a contractor.”

In addition to its other recommendations, the group suggested adjusting building codes to include a broader definition of “construction contractors” as a way to make sure all workers on the job site are held to the same standard.

In April, Mayor Bill Peduto signed an executive order to do just that in the City of Pittsburgh.

In response to recommendations from the same task force that gave the presentation Tuesday, the order directs the city’s departments of Finance and Permits, Licenses and Inspections (PLI) to form a committee to examine the city code and craft language to newly define the term. It also tasked PLI with publicly listing contractor names on the city’s BuildingEye website, another suggestion that the task force said would help hold employers accountable.

For state lawmakers, the task force also recommended imposing a civil penalty on employers for violations. Those penalties could be used to help fund the investigators and investigation process for looking into complaints and violations.

Lauren Rosenblatt: lrosenblatt@post-gazette.com, 412-263-1565.

First Published: July 13, 2021, 9:46 p.m.